Contents:

If you file your return electronically, you can attach your financial statements when you file. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study.

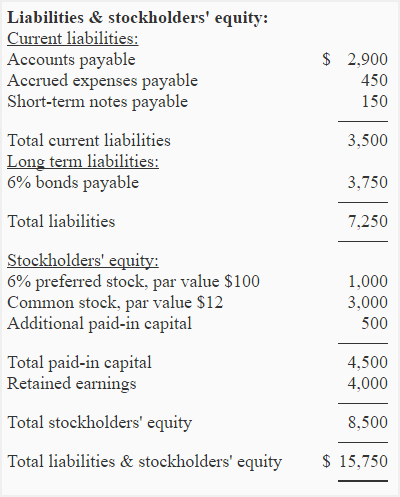

Include stock whose holders are guaranteed priority in the payment of dividends. Include the accumulated depreciation or amortization of any of the items on line 1900. Include the accumulated depreciation or amortization of any of the items on line 1787. If you are using the T1178, please tick the appropriate box to identify your opening balance sheet.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. Our Quantitative Research team models direct competitors or comparable companies from a bottom-up perspective to find companies describing their business in a similar fashion. SAN FRANCISCO — Bob Auer learned about growth stocks from his father. Now he’s applying those lessons to a mutual fund launched just four months ago.

GiftRocket Lets You Send Gifts That Can Be Redeemed At Specific Locations – TechCrunch

GiftRocket Lets You Send Gifts That Can Be Redeemed At Specific Locations.

Posted: Mon, 21 Mar 2011 07:00:00 GMT [source]

Watching this little gemAgain, a great company in a terrible oil servicing environment. Another swing down in oil prices will take it down to the 5 area where it would be a great long term buy. Again, a great company in a terrible oil servicing environment. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.

Notes to the financial statements

A Cook Islands Trust could be a potential vehicle for protecting those assets. All values as of most recently reported quarter unless otherwise noted. Upgrade to MarketBeat All Access to add more stocks to your watchlist. 2 employees have rated Gulf Island Fabrication Chief Executive Officer Richard W. Heo on Glassdoor.com.

- Include all amounts here that would have otherwise been reported under items 8161 to 8166.

- If you selected option 1 or 2 in Part 2 – Type of involvement with the financial statements, answer question 099 “Has the accountant expressed a reservation?”.

- Style is an investment factor that has a meaningful impact on investment risk and returns.

- The T5013 Partnership Information Return should include theT5013 Schedule 125 showing the income generated and expenses incurred by the partnership during the fiscal period.

- Include all amounts here that would have otherwise been reported under items 8501 to 8503.

Your balance sheet shows fixed assets of $31,500, with a breakdown found in the notes. For examples of how to use the GIFI for corporations and partnerships, see the Appendix D. The T5013 Partnership Information Return should include theT5013 Schedule 100 showing the partnership’s financial position at the end of the fiscal period. Report your financial statement information in Canadian funds even if you are a Canadian branch of a foreign partnership. Schedule 101 shows the corporation’s opening balance sheet information for the first return of a new corporation. If machinery fuel and lubricant expenses are related to farming activity, report them on line 9764 – Machinery fuel, or on line 9760 – Machinery expenses.

Another situation in which you may choose to submit a https://1investing.in/ statement is to report amounts broken down in the notes, such as rental loss. Include all amounts here that would have otherwise been reported under items 9815 and 9816, as well as salaries and wages paid to spouse. Include all amounts here that would have otherwise been reported under items 9571 to 9573, as well as resales and other rebates.

Completing the main and supplementary income statements

Include all amounts here that would have otherwise appeared under items 3541 to 3543. Do not reduce amounts on lines 1900 and 1901 by government grants and investment tax credits. You cannot include tables and graphs in the notes if you are filing a T2 return electronically.

Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price. Commissions earned on the sale of products or services by businesses such as advertising agencies, brokers, insurance agents, lottery ticket sales, sales representatives, and travel agencies. Some corporations or partnerships may present sales and cost of sale on their income statement, with commission earned being the net amount.

One share of GIFI stock can currently be purchased for approximately $3.48. The company is scheduled to release its next quarterly earnings announcement on Tuesday, May 9th 2023. Gulf Island Fabrication’s stock was trading at $5.13 at the beginning of the year. Since then, GIFI stock has decreased by 32.2% and is now trading at $3.48.

Earnings Preview: Gulf Island Fabrication

You can expect to be treated fairly under clear and established rules, and get a high level of service each time you deal with the Canada Revenue Agency ; see the Taxpayer Bill of Rights. Direct deposit is a fast, convenient, and secure way to get your CRA payments directly into your account at a financial institution in Canada. Footnote 1 Use the GIFI to report the breakdown of these amounts, rather than the net amount. You have to provide a description of the operation if it is different from the main activity. These items represent the net amount of proceeds over net book value on the disposal or sale of an asset. Amounts received from The Atlantic Groundfish Strategy or insurance proceeds.

- If you are using a software package, it will show you how to mark items as negative amounts.

- Investing.com – U.S. equities were lower at the close on Tuesday, as losses in the Consumer Services, Telecoms and Utilities sectors propelled shares lower.

- A loss on foreign exchange, subsidiaries/affiliates, other divisions, joint ventures, or partnerships shown as an expense should be reported under the appropriate item as a negative.

- To see all exchange delays and terms of use please see Barchart’s disclaimer.

- If you are preparing the tax return, but you are not the accountant referred to above, you must complete parts 1, 2, 3, and 4 as applicable.

- Include all amounts here that would have otherwise been reported under items 1601 and 1602.

It’s a grim reminder of how unforgiving this market has been that out of almost 3,000 diversified U.S. stock mutual-funds, only a handful are in the black so far this year. You can file a formal dispute or objection if you think the CRA misinterpreted the facts of your tax situation or applied the tax law incorrectly. If you are still not satisfied, you can file a service complaint by filling out form RC193, Service Feedback. For more information and how to file a complaint, go to Service Complaints. If you are not satisfied with the service you received, try to resolve the matter with the CRA employee you have been dealing with or call the telephone number provided in the CRA’s correspondence. If you do not have contact information, go to Contact information.

Sales & Book Value

Your software package should enable you to transfer the notes to the file you are transmitting, without re-keying. Items 9370 to 9899 relate specifically to farming income and expenses. When a corporate member of the partnership has elected to report in a functional currency, the partnership has to use the same functional currency when preparing the information slip for this corporate partner. Schedule 100 shows the corporation’s financial position at the end of the tax year.

T2 Corporation – Income Tax Guide – Before you start – Canada.ca

T2 Corporation – Income Tax Guide – Before you start.

Posted: Sun, 15 Oct 2017 18:24:52 GMT [source]

Part 2 shows how to report this type of information using the GIFI and how to balance your financial information. Note that the CRA would only receive the name, description of operations, and sequence number with the GIFI code and amount. You have to provide an operating name for each statement, except the summary statement , unless it is the same as the corporation’s or partnership’s legal name. Losses on disposal/sale of assets shown as a farm expense should be reported under this item as a negative. This item represents the net amount of item 8089 – Total sales of goods and services, less item 8518 – Cost of sales.

The how investors earn income from investing in etfs is available as part of the T2 tax return preparation software programs certified by the Canada Revenue Agency . It is also available as part of the T5013 partnership information return preparation software programs. The GIFI is included in some utility programs that allow you to import information from an accounting software program to a return preparation program. If you do not use return preparation software, seeWhat is the GIFI-Short? Once you choose a GIFI code for each item you report on your financial statements, only the item code and amount will be included on your return. Parts 1, 2, and 3 must be completed from the perspective of the person (referred to on the form as the “accountant”) who prepared, or reported on, the financial statements.

GIFI schedules for corporations

Gulf Island Fabrication Inc share price live 3.480, this page displays NASDAQ GIFI stock exchange data. View the GIFI premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Gulf Island Fabrication Inc real time stock price chart below.

Dawson Geophysical Company (DWSN) Stock Price Today, Quote … – Seeking Alpha

Dawson Geophysical Company (DWSN) Stock Price Today, Quote ….

Posted: Fri, 03 Jul 2015 14:21:23 GMT [source]

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

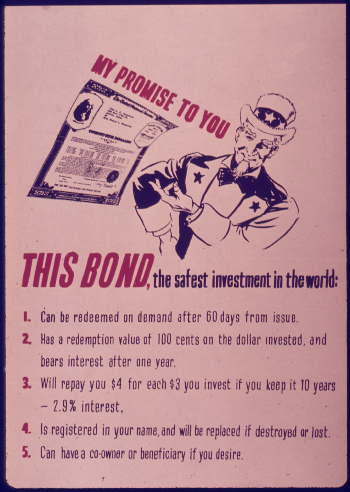

Include all amounts here that would have otherwise been reported under items 2701 to 2706, 2840, as well as corporate or demand loans, and loans from Canadian or foreign banks. Some of them include more detail about the type of information you could report in the item. Some items are intended for corporations only or for partnerships only. Some items apply only to certain industry sectors or types of business.

They are the generic items to use if the specific items in the block are not an exact match to the item on your financial statement. Enter your extraordinary items and income tax items on page 4 of Form T1178. Corporations involved in both farming and non-farming activities can select items from both statements. The T5013 Partnership Information Return should include theT5013 Schedule 125 showing the income generated and expenses incurred by the partnership during the fiscal period.

For penalties, the CRA will consider your request only if it relates to a tax year or fiscal period ending in any of the 10 calendar years before the year in which you make your request. For example, your request made in 2018 must relate to a penalty for a tax year or fiscal period ending in 2008 or later. CRABizApp is a mobile web app for small business owners and sole proprietors. The app offers secure access to view accounting transactions, pay outstanding balances, make interim payments, and more. They are not meant to dictate what to put on your statements or how to file. If the closing inventory is greater than the opening inventory, this item should be reported as a negative.

The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time.

Include all amounts here that would have otherwise been reported under items 8861 to 8877. Include all amounts here that would have otherwise been reported under items 8811 to 8813. Include all amounts here that would have otherwise been reported under items 8761 to 8764. Include all amounts here that would have otherwise been reported under items 8711 to 8717. Include all amounts here that would have otherwise been reported under items 8621 to 8623.